CONFIDENTIAL TREATMENT REQUESTED

As confidentially submitted with the Securities and Exchange Commission on July 11, 2014

pursuant to the Jumpstart Our Business Startups Act of 2012

This second draft registration statement has not been publicly filed with the Securities and Exchange Commission and

all information contained herein remains confidential

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FDO Holdings, Inc.*

(Exact name of registrant as specified in its charter)

Delaware |

5211 | 27-3730271 | ||

(State or other jurisdiction of |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2233 Lake Park Drive, Suite 400

Smyrna, Georgia 30080

(404) 471-1634

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Trevor S. Lang

Senior Vice President and Chief Financial Officer

FDO Holdings, Inc.

2233 Lake Park Drive, Suite 400

Smyrna, Georgia 30080

(404) 471-1634

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Monica Shilling, Esq. Proskauer Rose LLP 2049 Century Park East, Suite 3200 Los Angeles, CA 90067 Tel (310) 557-2900 Fax (310) 557-2193 |

David V. Christopherson, Esq. Vice President and General Counsel FDO Holdings, Inc. 2233 Lake Park Drive, Suite 400 Smyrna, GA 30080 Tel (404) 471-1634 Fax (404) 393-3540 |

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Stelios G. Saffos, Esq. Latham & Watkins LLP 885 Third Avenue New York, NY 10022 Tel (212) 906-1297 Fax (212) 751-4864 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||

|---|---|---|---|---|

Class A Common Stock, $0.001 par value per share |

$ | $ | ||

|

||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated ,

2014.

PROSPECTUS

Shares

Floor & Decor Holdings, Inc.

Class A Common Stock

This is Floor & Decor Holdings, Inc.'s initial public offering. We are selling shares of our Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. We expect the public offering price to be between $ and $ per share. We intend to apply to list our Class A common stock on the New York Stock Exchange under the symbol "FND."

Following this offering, we will have two classes of common stock outstanding: Class A common stock and Class C common stock. The rights of the holders of our Class A common stock and our Class C common stock are generally identical, except that shares of Class C common stock are non-voting. Our shares of Class C common stock also will automatically convert into shares of our Class A common stock upon certain circumstances. See "Description of Capital Stock—Common Stock—Conversion Rights."

We are an emerging growth company, as defined in Section 2(a) of the Securities Act of 1933, as amended (the "Securities Act") and will be subject to reduced public reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our Class A common stock involves risks that are described in the "Risk Factors" section beginning on page 19 of this prospectus.

| |

Per Share

|

Total

|

|||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discount(1) |

$ | $ | |||||

Proceeds, before expenses, to us |

$ | $ | |||||

The underwriters may also exercise their option to purchase up to an additional shares of Class A common stock from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

The shares will be ready for delivery on or about , 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| BofA Merrill Lynch | Goldman, Sachs & Co. | Barclays |

The date of this prospectus is , 2014.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be distributed to you. Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of Class A common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of such free writing prospectus.

Persons who come into possession of this prospectus and any such free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

i

This summary highlights the information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes, before making an investment decision. Some of the statements in this summary constitute forward-looking statements. See "Special Note Regarding Forward-Looking Statements."

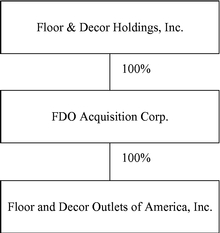

Prior to the effectiveness of the registration statement of which this prospectus is a part, we were renamed Floor & Decor Holdings, Inc. Except where the context suggests otherwise, the terms "Floor & Decor Holdings, Inc.," "Floor & Decor," the "Company," "we," "us," and "our" refer to Floor & Decor Holdings, Inc., a Delaware corporation formerly known as "FDO Holdings, Inc.," together with its consolidated subsidiaries. Because our Class C common stock generally has identical rights to our Class A common stock (except that Class C common stock is non-voting) and converts into our Class A common stock on a one-to-one basis under certain circumstances, we generally refer to our Class A common stock and Class C common stock collectively herein as our "common stock." Unless indicated otherwise, the information in this prospectus (i) has been adjusted to give effect to a -for-one stock split of our common stock effected on , 2014, (ii) assumes that all shares of our Class B common stock are automatically converted into shares of our Class A common stock upon the closing of this offering pursuant to our restated certificate of incorporation (our "certificate of incorporation") and (iii) assumes the underwriters will not exercise their option to purchase up to an additional shares of our Class A common stock.

Our Company

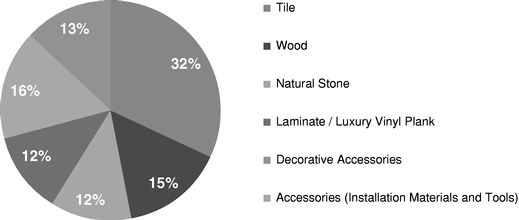

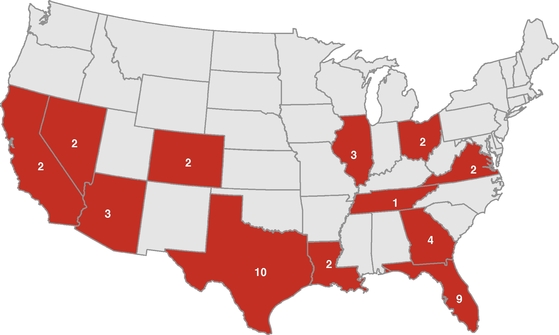

Floor & Decor is a highly differentiated, rapidly growing specialty retailer of hard surface flooring and related accessories with 41 warehouse-format stores across 12 states. We offer what we believe is the industry's broadest in-stock assortment of tile, wood, laminate and natural stone flooring along with decorative and installation accessories at everyday low prices. Our stores appeal to a variety of customers, including professional installers and commercial businesses ("Pro"), Do it Yourself customers ("DIY") and customers who buy the products for professional installation ("Buy it Yourself" or "BIY"). The combination of our category and product breadth, low prices, in-stock inventory in project-ready quantities and highly engaged customer service positions us to gain share in the growing and fragmented hard surface flooring market. Based on these characteristics, we believe Floor & Decor is redefining the hard surface flooring category and that we have an opportunity to significantly expand our store base to over 350 stores nationwide within the next 15 years, as described in more detail below.

Our warehouse-format stores, which average approximately 70,000 square feet, are typically larger than any of our specialty retail flooring competitors' stores. When our customers walk into a Floor & Decor store for the first time, we believe they are amazed by its size, our everyday low prices and the breadth and depth of our merchandise. Our stores are easy to navigate and designed to interactively showcase the wide array of designs and product styles a customer can create with our flooring and decorative accessories. We engage our customers through our trained store associates and designers, as well as our staff dedicated to serving Pro customers. In addition to our stores, our merchandise is also available at FloorandDecor.com for store pick-up or delivery. We believe these factors position Floor & Decor as the leading one stop destination for Pro, DIY and BIY hard surface flooring customers in our markets.

1

We believe our differentiated business model and culture have created competitive advantages that are responsible for our success, as evidenced by the following:

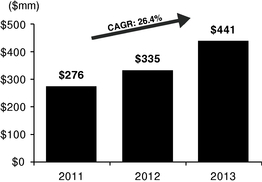

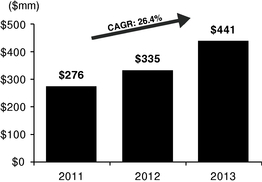

| Net Sales (FY2011 - FY2013) |

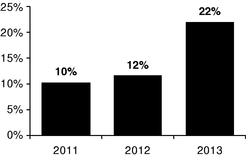

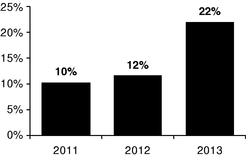

Comparable Store Sales Growth (FY2011 - FY2013) |

|

|

|

Our Competitive Strengths

We believe our strengths, described below, set us apart from our competitors and are the key drivers of our success.

Unparalleled Customer Value Proposition. Our customer value proposition is a critical driver of our business. The key components include:

Broadest Assortment Across a Wide Variety of Hard Surface Flooring Categories. Our stores are generally larger than those of our specialty retail flooring competitors. We believe we have the most comprehensive in-stock product assortment in the industry within our categories with on average approximately 3,400 SKUs in each store. Additionally, we customize our product assortment at the store level for the regional preferences of each market. We appeal to a wide range of customers through our "good/better/best" merchandise selection, as well as through our broad range of product styles from classic to modern.

Lowest Prices. We strive to provide the lowest prices in the retail hard surface flooring market. Our merchandising and individual store teams competitively shop each market so that we can offer our products at prices lower than those of our competitors. We believe we are unique in our industry in employing an "everyday low price" strategy, whereby we strive to offer our products at lower prices than our competitors and at consistently everyday low prices throughout the year instead of engaging in frequent promotional activities. We believe this strategy creates trust with our Pro, DIY and BIY customers that they will receive the lowest

2

prices at Floor & Decor without having to wait for a sale or negotiate to obtain the lowest price.

One-Stop Project Destination with Immediate Availability. Our stores stock job-size quantities to immediately fulfill a customer's entire flooring project. In addition, our large in-stock assortment, including decorative and installation accessories, differentiates us from our competitors. On average, each warehouse-format store carries 1.3 million square feet of flooring products and $2.4 million of inventory at cost.

Unique and Inspiring Shopping Environment. Our stores average approximately 70,000 square feet and are typically designed with warehouse features, including high ceilings, clear signage, bright lighting and industrial racking. We offer an easy to navigate store layout with clear lines of sight and departments organized by our major product categories of tile, wood, laminate, stone, decorative accessories and installation accessories. We encourage customers to interact with our merchandise, to experiment with potential designs and to see the actual product they will purchase, an experience that is not possible in flooring stores that do not carry in-stock inventory in project-ready quantities. The majority of our stores have design centers that showcase project ideas to further inspire our customers, and we employ experienced designers in all of our stores to provide free design consulting. We believe inspiring and educating customers within our stores provide us with a significant competitive advantage in serving our customers.

Extensive Service Offering to Enhance the Pro Customer Experience. Our focus on meeting the unique needs of the Pro customer, and by extension the BIY customer, drives our estimated sales mix of approximately 60% Pro and BIY customers, which we believe represents a significantly higher percentage than our competitors. We provide an efficient one-stop shopping experience for our Pro customers, offering low prices on a broad selection of high-quality flooring products, deep inventory levels to support immediate availability of our products and the convenience of early store hours. Additionally, each store has a dedicated Pro sales force offering a variety of services to Pro customers. We believe by serving the needs of the Pro, we drive repeat and high-ticket purchases from this attractive and loyal customer segment.

Decentralized Culture with an Experienced Store-Level Team and Emphasis on Training. We have a decentralized culture that empowers managers at the store and regional levels to make key decisions to maximize the customer experience. Our store managers, who carry the title Chief Executive Merchant, have significant flexibility to customize product mix, pricing, marketing, merchandising, visual displays and other elements in consultation with their regional senior directors and regional merchants. We tailor the merchandising assortment for each of our stores for local market preferences, which we believe differentiates us from our national competitors that tend to have standard assortments across markets. Throughout the year, we train all of our employees on a variety of topics, including product knowledge, leadership and store operations. We believe our decentralized culture and coordinated training foster an organization aligned around providing a superior customer experience, ultimately contributing to higher sales and profitability.

Sophisticated, Global Supply Chain. Our merchandising team has developed direct sourcing relationships with manufacturers and quarries in over 14 countries. We currently source our products from more than 180 vendors worldwide and have developed long-term relationships with many of them. We often collaborate with our vendors to design and manufacture products for us to address emerging customer preferences that we observe in our stores and markets. We procure the majority of our products directly from the manufacturers, which eliminates additional costs from exporters, importers, wholesalers and distributors. We believe direct sourcing is a key competitive advantage, as many of our specialty retail flooring competitors are too small to have the scale or the resources to work directly with suppliers. Our sophisticated supply chain and collaborative history with our sourcing partners enable us to quickly introduce innovative and quality merchandise at low prices.

3

Highly Experienced Management Team with Proven Track Record. Led by our Chief Executive Officer, Tom Taylor, our management team brings substantial expertise from leading retailers and other companies across core functions, including store operations, merchandising, real estate, e-commerce, supply chain management, finance, legal and information technology. Tom Taylor, who joined us in 2012, spent 23 years at The Home Depot, where he most recently served as Executive Vice President of Merchandising and Marketing with responsibility for all stores in the United States and Mexico. Our Executive Vice President and Chief Merchandising Officer, Lisa Laube, has approximately 30 years of merchandising and leadership experience with leading specialty retailers, including most recently as President of Party City. Our Senior Vice President and Chief Financial Officer, Trevor Lang, brings more than 19 years of accounting and finance experience, including 15 years of Chief Financial Officer and Vice President of Finance experience at public companies, including most recently as the Chief Financial Officer and Chief Administrative Officer of Zumiez Inc.

Our Growth Strategy

We expect to continue to drive our strong sales and profit growth through the following strategies:

Open Stores in New and Existing Markets. We believe there is an opportunity to significantly expand our store base in the United States from 41 warehouse-format stores currently to over 350 stores nationwide over the next 15 years based on our internal research with respect to housing density, demographic data, competitor concentration and other variables in both new and existing markets. We have a disciplined approach to new store development, based on an analytical, research-driven site selection method and a rigorous real estate approval process. We believe our new store model delivers strong financial results and returns on investment, targeting profitability in the first year, as well as pre-tax payback in the third year and year-three cash-on-cash returns of greater than 30%. The rate of future store additions and the performance of our new stores are inherently uncertain and are subject to numerous factors outside of our control. The performance of our new stores opened over the last three years, our disciplined real estate strategy and the track record of our management team in successfully opening retail stores support our belief in the significant store expansion opportunity.

Increase Comparable Store Sales. We expect to grow our comparable store sales by continuing to offer our customers a dynamic and expanding selection of compelling, value-priced hard surface flooring and accessories. Our newer stores will continue to drive comparable store sales growth as they ramp to maturity. We believe that we can continue to enhance our customer experience by focusing on service, optimizing sales and marketing strategies, investing in store staff and infrastructure, remodeling existing stores and improving visual merchandising and the overall aesthetic appeal of our stores. We also believe that growing our proprietary credit offering, further integrating omni-channel strategies and enhancing other key information technology, will contribute to increased comparable store sales. As we increase awareness of Floor & Decor's brand, we believe there is a significant opportunity to gain additional market share, especially from independent flooring retailers. We believe the combination of these initiatives plus the expected growth of the hard surface flooring category described in more detail under "Our Industry" below will continue to drive strong comparable store sales growth.

Continue to Invest in the Pro Customer. We believe our differentiated focus on Pro customers has created a competitive advantage for us and will continue to drive our sales growth. We will invest in gaining and retaining Pro customers due to their frequent and high-ticket purchases, loyalty and propensity to refer other potential customers. We plan to further invest in initiatives to increase speed of service, improve financing solutions, leverage technology and enhance the in-store experience for our Pro customers. We believe our approach in promoting Floor & Decor as a hub for the local home improvement community will drive additional Pro sales.

4

Expand Our Omni-Channel Experience. Extending the Floor & Decor experience online allows customers to explore our product selection and design ideas before and after visiting our stores, as well as the convenience of making online purchases. We believe our online platform reflects our brand attributes and provides a powerful tool to educate and inspire our consumers. With the recent launch of our redesigned website, FloorandDecor.com, we have enhanced our customer experience across our stores, call center and website. While the hard surface flooring category has a relatively low penetration of e-commerce sales due to the nature of the product, we believe our omni-channel presence represents an attractive growth opportunity to drive consumers to Floor & Decor.

Enhance Margins Through Increased Operating Leverage. Since 2011, we have invested significantly in our sourcing and distribution network, integrated IT systems and corporate overhead to support our future growth. We expect to leverage these investments as we grow our net sales. Additionally, we believe operating margin improvement opportunities will include enhanced product sourcing processes and overall leveraging of our store-level fixed costs, existing infrastructure, supply chain, corporate overhead and other fixed costs resulting from increased sales productivity. We anticipate that the planned expansion of our store base and growth in comparable store sales will also support increasing economies of scale.

Selected Risks

In considering our competitive strengths, our growth strategy and an investment in our common stock, you should carefully consider the risks highlighted in the section entitled "Risk Factors" following this prospectus summary. In particular, we face the following challenges:

For information regarding how our leverage affects our business, financial condition and operating results, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources."

5

Our Industry

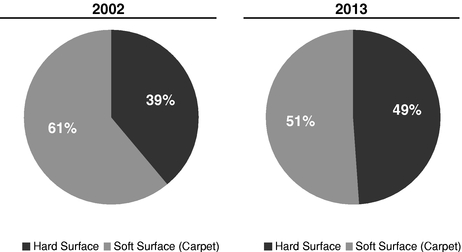

Floor & Decor operates in the large, growing and highly fragmented $10 billion hard surface flooring market (in manufacturers' dollars), which is part of the larger $20 billion U.S. floor coverings market (in manufacturers' dollars) based on a 2013 study by Catalina Research, Inc., a leading provider of market research for the floor coverings industry (the "Catalina Floor Coverings Report"). The competitive landscape of the hard surface flooring market includes big-box home improvement centers, national and regional specialty flooring retailers, and independent flooring retailers. We believe we benefit from growth in the overall hard surface flooring market, which, based on the Catalina Floor Coverings Report, is expected to grow more than 5% per year through 2018. In addition, we believe we have an opportunity to increase our share in the hard surface flooring market as independent flooring retailers are unable to compete on price and in-stock assortment.

Concurrent Transactions—Common Stock Changes

Prior to or concurrently with the closing of this offering:

We refer to these changes herein as the "Common Stock Changes." See "Description of Capital Stock" for more information.

Our Sponsors

Upon the closing of this offering, Ares Corporate Opportunities Fund III, L.P. ("Ares"), a fund affiliated with Ares Management, L.P. ("Ares Management"), will beneficially own, in the aggregate, approximately % of our outstanding Class A common stock and FS Equity Partners VI, L.P. and FS Affiliates VI, L.P., funds affiliated with Freeman Spogli & Co. (collectively "Freeman Spogli" and together with Ares, our "Sponsors"), will beneficially own, in the aggregate, approximately % of our outstanding Class A common stock and 100% of our outstanding Class C common stock. These amounts compare to approximately % of our outstanding Class A common stock represented by the shares sold by us in this offering, assuming no exercise of the underwriters' option to purchase additional shares. As a result, these stockholders acting together, or Ares or Freeman Spogli acting alone, will be able to exercise significant influence over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, such as a merger or other sale of us or our assets. Also, our Sponsors may acquire or hold interests in businesses that compete directly with us, or may pursue acquisition opportunities that are complementary to our business, making such acquisitions unavailable to us. The Investor Rights Agreement (as defined in "Certain Relationships and Related Party Transactions") also contains agreements among our Sponsors with respect to voting on the election of directors and board committee membership. See "Risk Factors—Risks Related to this Offering and Ownership of Our Common Stock—Our principal stockholders will continue to have substantial control over us after this offering, will be able to influence corporate matters and may take actions that conflict with your interest and have the effect of delaying or preventing changes of control or changes in management, or limiting the ability of other stockholders to approve transactions they deem to be in their best interest."

6

Ares Management

Ares Management is a leading global alternative asset manager with approximately $77 billion of assets under management and approximately 700 employees in over 15 offices in the United States, Europe and Asia as of March 31, 2014. Since its inception in 1997, Ares Management has adhered to a disciplined investment philosophy that focuses on delivering strong risk-adjusted investment returns throughout market cycles. Ares Management believes each of its four distinct but complementary investment groups in Tradable Credit, Direct Lending, Private Equity and Real Estate is a market leader based on assets under management and investment performance. Ares Management was built upon the fundamental principle that each group benefits from being part of the greater whole.

Ares Management's Private Equity Group has approximately $10 billion of assets under management, targeting investments in high quality franchises across multiple industries. In the consumer / retail sector, selected current investments include 99 Cents Only Stores LLC, Smart & Final Stores, Inc., Guitar Center Holdings, Inc., Neiman Marcus Group LTD LLC and the parent company of Serta International and Simmons Bedding Company. Selected prior investments include GNC Holdings, Inc., House of Blues Entertainment, LLC, Maidenform Brands, Inc. and Samsonite Corporation.

Freeman Spogli & Co.

Freeman Spogli & Co. is a private equity firm dedicated exclusively to investing and partnering with management in consumer-related and distribution companies in the United States. Since its founding in 1983, Freeman Spogli & Co. has invested $3.3 billion of equity in 50 portfolio companies with aggregate transaction values of $20 billion.

Corporate and Other Information

Prior to the effectiveness of the registration statement of which this prospectus is a part, we were renamed Floor & Decor Holdings, Inc. Our principal executive offices are located at 2233 Lake Park Drive, Suite 400, Smyrna, GA 30080, and our telephone number is (404) 471-1634. Our website address is www.FloorandDecor.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

This prospectus includes our trademarks and trade names, including Floor & Decor® and our logo, which are protected under applicable intellectual property laws and are the property of our wholly owned subsidiary, Floor and Decor Outlets of America, Inc., a Delaware corporation ("F&D"). This prospectus also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks, service marks and trade names referred to in this prospectus may appear without the ® or TM symbols. We do not intend our use or display of other parties' trademarks, service marks or trade names to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), and we are eligible to take advantage of certain exemptions from various

7

reporting requirements that are applicable to other public companies that are not emerging growth companies. These provisions include, among other matters:

We have determined to opt out of the exemption from compliance with new or revised financial accounting standards. Our decision to opt out of this exemption is irrevocable.

We have elected to adopt the reduced disclosure requirements and the exemption from the auditor attestation requirement available to emerging growth companies. As a result of these elections, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold, or may contemplate holding, equity interests. In addition, it is possible that some investors will find our common stock less attractive as a result of our elections, which may cause a less active trading market for our common stock and more volatility in our stock price.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the closing of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of the most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

8

Class A common stock |

shares (plus up to an additional shares of our Class A common stock that we may issue and sell upon the exercise of the underwriters' option to purchase additional shares) | |

Option to purchase additional shares of Class A common stock |

The underwriters have the option for 30 days following the date of this prospectus to purchase up to an additional shares of Class A common stock from us at the initial public offering price less the underwriting discount. |

|

Common stock to be outstanding after this offering |

shares (including shares of Class C common stock) |

|

Voting rights |

Each holder of our Class A common stock is entitled to one vote for each share of Class A common stock held on all matters submitted to a vote of stockholders. Holders of our Class C common stock are not entitled to vote on such matters, except as required under Delaware law. Our stockholders do not have cumulative voting rights. |

|

Use of proceeds |

We estimate that the net proceeds we will receive from selling common stock in this offering will be approximately , after deducting estimated offering expenses of approximately (or, if the underwriters exercise their option to purchase additional shares in full, approximately , after deducting the estimated offering expenses of approximately million). |

|

|

We intend to use the net proceeds of this offering as follows: |

|

|

(i) first, to repay all or a portion of the amounts outstanding under the GCI Facility (as defined below), including accrued and unpaid interest and the applicable prepayment penalty; |

|

|

(ii) second, to repay all or a portion of the amounts outstanding under the Wells Facility Term Loan A (as defined below), including accrued and unpaid interest; and |

|

|

(iii) third, to repay $ of the outstanding indebtedness under the Wells Facility Revolving Line of Credit (as defined below) and for other general corporate purposes. |

|

|

Any amounts repaid under the GCI Facility and the Wells Facility Term Loan A will not be available for future borrowing following repayment. If all amounts outstanding under the GCI Facility and the Wells Facility Term Loan A are repaid with a portion of the net proceeds from this offering, the GCI Facility and the Wells Facility Term Loan A will each be terminated. |

9

Directed share program |

The underwriters have reserved up to % of the shares of Class A common stock being offered by this prospectus for sale, at the initial public offering price, to our directors, officers, employees and other parties related to us and members of their respective families. The sales will be made by through a directed share program. We do not know if these persons will elect to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available for sale to the general public. Any reserved shares not purchased will be offered by the underwriters to the general public on the same terms as the other shares of our Class A common stock. |

|

Dividend policy |

We currently intend to retain all available funds and any future earnings for use in the operation and growth of our business, and therefore we do not currently expect to pay any cash dividends on our common stock. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on then existing conditions, including our operating results, financial condition, contractual restrictions, capital requirements, business prospects and other factors that our board of directors may deem relevant. In addition, our Credit Facilities (as defined below) contain covenants that restrict our ability to pay cash dividends. See "Dividend Policy." |

|

Risk factors |

Investing in shares of our common stock involves a high degree of risk. See "Risk Factors" beginning on page 19 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Class A common stock. |

|

Proposed New York Stock Exchange trading symbol |

"FND" |

Unless otherwise indicated, all information in this prospectus:

10

The number of shares of common stock to be outstanding after this offering is based on shares of our common stock outstanding immediately prior to the closing of this offering, and excludes the following:

11

Summary Consolidated Financial and Other Data

The following tables summarize our financial data as of the dates and for the periods indicated. We have derived the consolidated statement of income and consolidated balance sheet data as of and for the fiscal years ended on December 26, 2013, December 27, 2012, and December 29, 2011 from our audited consolidated financial statements for such years and for the thirteen weeks ended on March 27, 2014 and March 28, 2013 from our unaudited condensed consolidated financial statements for such periods. Our audited consolidated financial statements as of and for the fiscal years ended on December 26, 2013, December 27, 2012, and December 29, 2011 have been included in this prospectus. Our unaudited condensed consolidated financial statements as of and for the thirteen weeks ended on March 27, 2014 and March 28, 2013 have been included in this prospectus and, in the opinion of management, include all adjustments (inclusive only of normally recurring adjustments) necessary for a fair presentation. Historical results are not indicative of the results to be expected in the future and operating results for an interim period are not necessarily indicative of results for a full year.

You should read the following information together with the more detailed information contained in "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the accompanying notes appearing elsewhere in this prospectus.

12

| |

Fiscal year ended(1) | Thirteen weeks ended(1) |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(in thousands, except share and per share amounts) |

December 26, 2013 |

December 27, 2012 |

December 29, 2011 |

March 27, 2014 |

March 28, 2013 |

|||||||||||

Consolidated statement of income data: |

||||||||||||||||

Net sales |

$ | 441,394 | $ | 335,088 | $ | 276,358 | $ | 126,953 | $ | 98,728 | ||||||

Cost of sales |

270,103 | 199,900 | 163,395 | 75,208 | 59,555 | |||||||||||

| | | | | | | | | | | | | | | | | |

Gross profit |

171,291 | 135,188 | 112,963 | 51,745 | 39,173 | |||||||||||

Selling and store operating expenses |

107,097 | 86,025 | 73,340 | 32,886 | 24,311 | |||||||||||

General and administrative expenses |

31,736 | 21,572 | 16,352 | 9,077 | 6,987 | |||||||||||

Pre-opening expenses |

5,196 | 1,544 | 2,250 | 996 | 725 | |||||||||||

Executive severance(2) |

— | — | — | 2,975 | — | |||||||||||

Casualty gain(3) |

— | (1,421 | ) | — | — | — | ||||||||||

| | | | | | | | | | | | | | | | | |

Operating income |

27,262 | 27,468 | 21,021 | 5,811 | 7,150 | |||||||||||

Interest expense |

7,684 | 6,528 | 7,031 | 2,265 | 1,643 | |||||||||||

Loss on early extinguishment of debt |

1,638 | — | 1,801 | — | — | |||||||||||

| | | | | | | | | | | | | | | | | |

Income before income taxes |

17,940 | 20,940 | 12,189 | 3,546 | 5,507 | |||||||||||

Provision for income taxes |

6,857 | 8,102 | 4,702 | 1,358 | 2,120 | |||||||||||

| | | | | | | | | | | | | | | | | |

Net income |

$ | 11,083 | $ | 12,838 | $ | 7,487 | $ | 2,188 | $ | 3,387 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Earnings per share: |

||||||||||||||||

Basic |

$ | 42.92 | $ | 49.90 | $ | 29.10 | $ | 8.47 | $ | 13.13 | ||||||

Diluted |

$ | 42.55 | $ | 49.88 | $ | 29.05 | $ | 8.27 | $ | 13.09 | ||||||

Weighted average shares outstanding: |

||||||||||||||||

Basic |

258,232 | 257,280 | 257,280 | 258,320 | 258,053 | |||||||||||

Diluted |

260,451 | 257,391 | 257,751 | 264,682 | 258,843 | |||||||||||

Pro forma earnings per share(4): |

||||||||||||||||

Basic |

$ | $ | ||||||||||||||

Diluted |

$ | $ | ||||||||||||||

Pro forma weighted average shares outstanding(4): |

||||||||||||||||

Basic |

||||||||||||||||

Diluted |

||||||||||||||||

| |

Fiscal year ended(1) | Thirteen weeks ended(1) |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(in thousands)

|

December 26, 2013 |

December 27, 2012 |

December 29, 2011 |

March 27, 2014 |

March 28, 2013 |

|||||||||||

Consolidated statement of cash flows data: |

||||||||||||||||

Net cash (used in) provided by operating activities |

$ | (15,428 | ) | $ | 23,336 | $ | 7,947 | $ | 19,391 | $ | 6,986 | |||||

Net cash used in investing activities |

(25,056 | ) | (10,709 | ) | (9,561 | ) | (6,942 | ) | (5,081 | ) | ||||||

Net cash provided by (used in) financing activities |

40,487 | (15,777 | ) | 3,501 | (12,467 | ) | (1,185 | ) | ||||||||

13

| |

As of December 26, 2013(1) |

As of March 27, 2014(1) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(in thousands)

|

Actual | Pro forma as adjusted(5) |

Actual | Pro forma as adjusted(5) |

|||||||||

Consolidated balance sheet data: |

|||||||||||||

Cash and cash equivalents |

$ | 175 | $ | $ | 157 | $ | |||||||

Net working capital |

95,367 | 84,474 | |||||||||||

Total assets |

562,342 | 556,459 | |||||||||||

Total debt(6) |

159,667 | 147,200 | |||||||||||

Total stockholders' equity |

264,132 | 266,820 | |||||||||||

| |

Fiscal year ended(1) | Thirteen weeks ended(1) |

|

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

December 26, 2013 |

December 27, 2012 |

December 29, 2011 |

March 27, 2014 |

March 28, 2013 |

|

|||||||||||

Other financial data: |

|||||||||||||||||

Comparable store sales growth |

22.1 | % | 11.6 | % | 10.1 | % | 11.5 | % | 21.7 | % | |||||||

Number of stores open at the end of the period(7) |

39 | 31 | 29 | 39 | 32 | ||||||||||||

Adjusted EBITDA (in thousands)(8) |

$ | 41,791 | $ | 35,574 | $ | 29,846 | $ | 12,744 | $ | 9,587 | |||||||

Adjusted EBITDA margin |

9.5 | % | 10.6 | % | 10.8 | % | 10.0 | % | 9.7 | % | |||||||

14

(in thousands)

|

Fiscal year ended December 26, 2013(1) |

Thirteen weeks ended March 27, 2014(1) |

|||||

|---|---|---|---|---|---|---|---|

Net income, as reported |

$ | 11,083 | $ | 2,188 | |||

Decrease in interest expense(a) |

|||||||

Elimination of loss on early extinguishment of debt(b) |

|||||||

| | | | | | | | |

Pro forma net income |

$ | $ | |||||

| | | | | | | | |

| | | | | | | | |

The following is a reconciliation of historical interest expense to pro forma interest expense for fiscal 2013 and the thirteen weeks ended March 27, 2014:

(in thousands)

|

Fiscal year ended December 26, 2013(1) |

Thirteen weeks ended March 27, 2014(1) |

|||||

|---|---|---|---|---|---|---|---|

Interest expense, as reported |

$ | 7,684 | $ | 2,265 | |||

Increase attributable to the 2013 Refinancing(c) |

|||||||

Decrease attributable to this offering(d) |

|||||||

| | | | | | | | |

Net decrease |

|||||||

| | | | | | | | |

Pro forma interest expense |

$ | $ | |||||

| | | | | | | | |

| | | | | | | | |

15

A

$1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) the pro forma as adjusted total debt and total stockholders' equity

after this offering by $ and $ , respectively, assuming the number of shares offered by us, as set forth on

the cover page of this prospectus, remained the same and after

deducting the underwriting discount and estimated offering expenses payable by us.

Similarly, a one million share increase (decrease) in the number of shares offered by us, as set forth on the cover of this prospectus, would increase (decrease) the pro forma as adjusted total debt and total stockholders' equity after this offering by $ and $ , respectively, assuming the assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus) remained the same and after deducting the underwriting discount and estimated offering expenses payable by us.

EBITDA and Adjusted EBITDA are key metrics used by management and our board of directors to assess our financial performance. We believe that EBITDA and Adjusted EBITDA are useful measures, as they eliminate certain expenses that are not indicative of the underlying business performance and facilitate a comparison of our operating performance on a consistent basis from period to period. For example, pre-opening expenses are generally incurred during the five-month period prior to a store opening and then are not incurred again for the applicable store. Unlike expenses that will generally recur as the store matures (e.g., personnel wages, supplies), we believe that these pre-opening expenses are not indicative of our underlying business performance for that store and we therefore eliminate these expenses in the adjustments made to determine Adjusted EBITDA. We also use Adjusted EBITDA as a basis to determine covenant compliance with respect to our Credit Facilities, to evaluate the performance of our executive officers, to supplement GAAP measures of performance to

16

evaluate the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against that of other peer companies using similar measures. EBITDA and Adjusted EBITDA are also used by analysts, investors and other interested parties as performance measures to evaluate companies in our industry.

| |

Fiscal year ended(1) | Thirteen weeks ended(1) |

|

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(in thousands)

|

December 26, 2013 |

December 27, 2012 |

December 29, 2011 |

March 27, 2014 |

March 28, 2013 |

|

|||||||||||

Net income |

$ | 11,083 | $ | 12,838 | $ | 7,487 | $ | 2,188 | $ | 3,387 | |||||||

Depreciation and amortization(a) |

6,420 | 4,678 | 4,065 | 2,440 | 1,198 | ||||||||||||

Interest expense |

7,684 | 6,528 | 7,031 | 2,265 | 1,643 | ||||||||||||

Loss on early extinguishment of debt(b) |

1,638 | — | 1,801 | — | — | ||||||||||||

Income tax expense |

6,857 | 8,102 | 4,702 | 1,358 | 2,120 | ||||||||||||

| | | | | | | | | | | | | | | | | | |

EBITDA |

33,682 | 32,146 | 25,086 | 8,251 | 8,348 | ||||||||||||

Pre-opening expenses(c) |

5,196 | 1,544 | 2,250 | 996 | 725 | ||||||||||||

Stock compensation expense(d) |

1,869 | 978 | 740 | 542 | 460 | ||||||||||||

Loss (gain) on asset disposal(e) |

656 | 157 | 14 | (20 | ) | — | |||||||||||

Executive recruiting/relocation(f) |

54 | 751 | 1,029 | — | 54 | ||||||||||||

Other(g) |

334 | (2 | ) | 727 | 2,975 | — | |||||||||||

| | | | | | | | | | | | | | | | | | |

Adjusted EBITDA |

$ | 41,791 | $ | 35,574 | $ | 29,846 | $ | 12,744 | $ | 9,587 | |||||||

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

17

18

You should carefully consider the risks described below, together with all of the other information included in this prospectus, including our consolidated financial statements and the related notes thereto, before making an investment decision. The risks and uncertainties set out below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition and operating results. If any of the following events occur, our business, financial condition and operating results could be materially and adversely affected. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

Our business, financial condition and operating results are dependent on general economic conditions and discretionary spending by our customers, which in turn are affected by a variety of factors beyond our control. If such conditions deteriorate, our business, financial condition and operating results may be adversely affected.

Our business, financial condition and operating results are affected by general economic conditions and discretionary spending by our customers. Such general economic conditions and discretionary spending are beyond our control and are affected by, among other things:

If such conditions deteriorate, our business, financial condition and operating results may be adversely affected. In addition, increasing volatility in financial and capital markets may cause some of the above factors to change with a greater degree of frequency and magnitude than in the past.

The hard surface flooring industry depends on home remodeling activity and other important factors.

The hard surface flooring industry is highly dependent on the remodeling of existing homes and, to a lesser extent, new home construction. In turn, remodeling and new home construction depend on a number of factors that are beyond our control, including interest rates, tax policy, employment

19

levels, consumer confidence, credit availability, real estate prices, existing home sales, demographic trends, weather conditions, natural disasters and general economic conditions. In particular:

Any one or a combination of these factors could result in decreased demand for our products, reduce spending on homebuilding or remodeling of existing homes or cause purchases of new homes to decline. While the vast majority of our sales are derived from home remodeling activity as opposed to new home construction, a decrease in any of these areas would adversely affect our business, financial condition and operating results.

Any failure by us to successfully anticipate trends may lead to loss of consumer acceptance of our products, resulting in reduced net sales.

Each of our stores is stocked with a customized product mix based on consumer demands in a particular market. Our success therefore depends on our ability to anticipate and respond to changing trends and consumer demands in these markets in a timely manner. If we fail to identify and respond to emerging trends, consumer acceptance of our merchandise and our image with current or potential customers may be harmed, which could reduce our net sales. Additionally, if we misjudge market trends, we may significantly overstock unpopular products, incur excess inventory costs and be forced to reduce the sales price of such products or incur inventory write-downs, which would adversely affect our operating results. Conversely, shortages of products that prove popular could also reduce our net sales through missed sales and a loss of customer loyalty.

If we fail to successfully manage the challenges that our planned new store growth poses or encounter unexpected difficulties during our expansion, our operating results and future growth opportunities could be adversely affected.

We have 41 warehouse-format stores and one small-format standalone design center located throughout the United States. We plan to open approximately five to six additional stores in 2014 and to significantly increase the number of new stores that we open during each of the next several years thereafter. This growth strategy and the investment associated with the development of each new store may cause our operating results to fluctuate and be unpredictable or decrease our profits. Our future operating results will depend on various factors, including the successful selection of new markets and store locations, our ability to negotiate leases on acceptable terms and our ability to attract, train and retain highly qualified managers and staff. We cannot ensure that store locations will be available to us, or that they will be available on terms acceptable to us. If additional retail store locations are unavailable on acceptable terms, we may not be able to carry out a significant part of our growth strategy.

In addition, consumers in new markets may be less familiar with our brand, and we may need to increase brand awareness in such markets through additional investments in advertising. Stores opened in new markets may have higher construction, occupancy or operating costs, or may have lower sales, than stores opened in the past. In addition, laws or regulations in these new markets may make opening new stores more difficult or cause unexpected delays. Newly opened stores may not succeed or may reach profitability more slowly than we expect, and the ramp-up to profitability may become

20

longer in the future as we enter more markets and add stores to markets where we already have a presence. Future markets and stores may not be successful and, even if they are successful, our comparable store sales may not increase at historical rates. To the extent that we are not able to overcome these various challenges, our operating results and future growth opportunities could be adversely affected.

Increased competition could cause price declines, decrease demand for our products and decrease our market share.

We operate in the hard surface flooring industry, which is highly fragmented and competitive. We face competition from large home improvement centers, national and regional specialty flooring chains and independent flooring retailers. Among other things, we compete on the basis of breadth of product assortment, low prices, and the in-store availability of the products we offer in project-ready quantities, as well as the quality of our customer service. As we expand into new and unfamiliar markets, we may experience different competitive conditions than in the past.

Some of our competitors are organizations that are larger, are better capitalized, have existed longer, have product offerings that extend beyond hard surface flooring and related accessories and have a more established market presence with substantially greater financial, marketing, personnel and other resources than we have. In addition, while the hard surface flooring category has a relatively low threat of new internet-only entrants due to the nature of the product, the growth opportunities presented by e-commerce could outweigh these challenges and result in increased competition. Competitors may forecast market developments more accurately than we do, offer similar products at a lower cost or adapt more quickly to new trends and technologies or evolving customer requirements than we do. Further, because the barriers to entry into the hard surface flooring industry are relatively low, manufacturers and suppliers of flooring and related products, including those whose products we currently sell, could enter the market and start directly competing with us. Intense competitive pressures from any of our present or future competitors could cause price declines, decrease demand for our products and decrease our market share. Moreover, in the future, changes in consumer preferences may cause hard surface flooring to become less popular than other types of floor coverings. Such a change in consumer preferences could lead to decreased demand for our products.

All of these factors may harm us and adversely affect our net sales, market share and operating results.

Our operating results may be adversely affected by fluctuations in material and energy costs.

Our operating results may be affected by the wholesale prices of hard surface flooring products, setting and installation materials and the related accessories that we sell. These prices may fluctuate based on a number of factors beyond our control, including the price of raw materials used in the manufacture of hard surface flooring, energy costs, changes in supply and demand, general economic conditions, labor costs, competition, import duties, tariffs, currency exchange rates and government regulation. In particular, energy costs have fluctuated dramatically in the past and may fluctuate in the future. These fluctuations may result in an increase in our transportation costs for distribution from the manufacturer to our distribution centers and from our distribution centers to our retail stores, utility costs for our distribution centers and retail stores and overall costs to purchase products from our suppliers.

We may not be able to adjust the prices of our products, especially in the short-term, to recover these cost increases, and a continual rise in such costs could adversely affect consumer spending and demand for our products and increase our operating costs, both of which could adversely affect our business, financial condition and operating results.

21

Our future success is dependent on our ability to execute our business strategy effectively and deliver value to our customers.

We believe our future success will depend on our ability to execute our business strategy effectively and deliver value to our customers. We believe that our breadth of product assortment across a variety of hard surface flooring categories, low prices, and in-store availability of the products we offer in project-ready quantities, as well as the quality of our customer service, are among the key competitive advantages and important elements of our total value proposition. If we are unsuccessful in staying competitive with our current value proposition, the demand for our products would decrease, and customers may decide to purchase products from our competitors instead of us. If this were to occur, our net sales, market share and operating results would be adversely affected.

Our operating results may be adversely affected if we are not successful in managing our inventory.

We currently maintain a high level of inventory consisting of on average approximately 3,400 SKUs per store and an average inventory per store of approximately $2.4 million at cost in order to have a broad assortment of products across a wide variety of hard surface flooring categories in project-ready quantities. We also carry an additional $54.8 million of inventory outside our stores, primarily at our four distribution centers. The investment associated with this high level of inventory is substantial, and efficient inventory management is a key component of our business success and profitability. If we fail to adequately project the amount or mix of our inventory, we may miss sales opportunities or have to take unanticipated markdowns or hold additional clearance events to dispose of excess inventory, which will adversely affect our operating results.

In the past, we have incurred costs associated with inventory markdowns and obsolescence. Due to the likelihood that we will continue to incur such costs in the future, we generally include an allowance for such costs in our projections. However, the costs that we actually incur may be substantially higher than our estimate and adversely affect our operating results.

We continue to focus on ways to reduce these risks, but we cannot assure you that we will be successful in our inventory management.

Our operating results may be adversely affected by inventory shrinkage and damage.

We are subject to the risk of inventory shrinkage and damage. We have experienced charges in the past, and we cannot assure you that the measures we are taking will effectively address the problem of inventory shrinkage and damage in the future. Although some level of inventory shrinkage and damage is an unavoidable cost of doing business, we could experience higher-than-normal rates of inventory shrinkage and damage or incur increased security and other costs to combat inventory theft and damage. If we are not successful in managing our inventory balances, our operating results may be adversely affected.

If we are unable to enter into leases for additional stores on acceptable terms or renew or replace our current store leases, or if one or more of our current leases is terminated prior to expiration of its stated term, and we cannot find suitable alternate locations, our growth and profitability could be adversely affected.

We currently lease all of our store locations and our store support center. Our growth strategy largely depends on our ability to identify and open future store locations, which can be difficult because our stores generally require at least 50,000 square feet of floor space. Our ability to negotiate acceptable lease terms for these store locations, to re-negotiate acceptable terms on expiring leases or to negotiate acceptable terms for suitable alternate locations could depend on conditions in the real estate market, competition for desirable properties, our relationships with current and prospective landlords, or on other factors that are not within our control. Any or all of these factors and conditions could adversely affect our growth and profitability.

22

We will require significant capital to fund our expanding business, which may not be available to us on satisfactory terms or at all. If we are unable to maintain sufficient levels of cash flow or if we do not have sufficient availability under the Wells Facility, we may not meet our growth expectations or we may require additional financing, which could adversely affect our financial health and impose covenants that limit our business activities.

We plan to continue investing for growth, including opening new stores, remodeling existing stores, adding staff and upgrading our information technology systems and other infrastructure. These investments will require significant capital, which we plan on funding with cash flow from operations and borrowings under the Wells Facility.

If our business does not generate sufficient cash flow from operations to fund these activities or if these investments do not yield cash flows in line with past performance or our expectations, we may need additional equity or debt financing. If such financing is not available to us, or is not available on satisfactory terms, our ability to operate and expand our business or respond to competitive pressures would be curtailed, and we may need to delay, limit or eliminate planned store openings or operations or other elements of our growth strategy. If we raise additional capital by issuing equity securities or securities convertible into equity securities, your ownership would be diluted.

Our net sales growth could be adversely affected if comparable store sales growth is less than we expect.

While future net sales growth will depend substantially on our plans for new store openings, our comparable store sales growth is a significant driver of our net sales, profitability and overall business results. Because numerous factors affect our comparable store sales growth, including, among others, economic conditions, the retail sales environment, the home improvement spending environment, housing turnover, the hard surface flooring industry and the impact of competition, the ability of our customers to obtain credit, changes in our product mix, the in-stock availability of products that are in demand, changes in staffing at our stores, cannibalization resulting from the opening of new stores in existing markets, lower than expected ramp-up in new store sales, changes in advertising and other operating costs, weather conditions, retail trends and our overall ability to execute our business strategy and planned growth effectively, it is possible that we will not achieve our targeted comparable store sales growth or that the change in comparable store sales could be negative. If this were to happen, it is likely that overall net sales growth would be adversely affected.

We depend on a number of suppliers, and any failure by any of them to supply us with quality products on attractive terms and prices may adversely affect our business, financial condition and operating results.

We depend on our suppliers to deliver quality products to us on a timely basis at attractive prices. However, in the future, we may not be able to acquire desired merchandise in sufficient quantities on terms acceptable to us, which may impair our relationship with our customers, impair our ability to attract new customers, reduce our competitiveness and adversely affect our business, financial condition and operating results.

We do not control the operations of our suppliers. Although we conduct an initial due diligence investigation prior to engaging our suppliers, we cannot guarantee that our suppliers will comply with applicable laws and regulations or operate in a legal, ethical and responsible manner. Violation of applicable laws and regulations by our suppliers or their failure to operate in a legal, ethical or responsible manner, could expose us to legal risks and reduce demand for our products if, as a result of such violation or failure, we attract negative publicity. In addition, the failure of our suppliers to adhere to the quality standards that we set for our products could lead to litigation and recalls, which could damage our reputation and our brand, increase our costs, and otherwise adversely affect our business.

23

We source the products that we sell from over 180 domestic and international suppliers. We procure the majority of our products from suppliers located outside of the United States. As a result, we are subject to risks associated with obtaining products from abroad, including:

These and other factors beyond our control could disrupt the ability of our suppliers to ship certain products to us cost-effectively or at all, which could adversely affect our operations.

If we fail to identify and maintain relationships with a sufficient number of suppliers, our ability to obtain products that meet our high quality standards at attractive prices could be adversely affected.

We purchase flooring and other products directly from suppliers located around the world. However, we do not have long-term contractual supply agreements with our suppliers that obligate them to supply us with products exclusively or at specified quantities or prices. As a result, our current suppliers may decide to sell products to our competitors and may not continue selling products to us. In order to retain the competitive advantage that we believe results from these relationships, we need to continue to identify, develop and maintain relationships with qualified suppliers that can satisfy our high standards for quality and our requirements for flooring and other products in a timely and efficient manner at attractive prices. The need to develop new relationships will be particularly important as we seek to expand our operations and enhance our product offerings in the future. The loss of one or more of our existing suppliers or our inability to develop relationships with new suppliers could reduce our competitiveness, slow our plans for further expansion and cause our net sales and operating results to be adversely affected.

Our ability to offer compelling products, particularly products made of more exotic species or unique stone, depends on the continued availability of sufficient suitable natural products.

Our business strategy depends on offering a wide assortment of compelling products to our customers. We sell, among other things, flooring made from various wood species and natural stone from quarries throughout the world. Our ability to obtain an adequate volume and quality of hard-to-find products depends on our suppliers' ability to furnish those products, which, in turn, could be affected by many things, including events such as forest fires, insect infestation, tree diseases, prolonged drought, other adverse weather and climate conditions and the exhaustion of stone quarries. Government regulations relating to forest management practices also affect our suppliers' ability to

24

harvest or export timber and other products, and changes to regulations and forest management policies, or the implementation of new laws or regulations, could impede their ability to do so. If our suppliers cannot deliver sufficient products, and we cannot find replacement suppliers, our net sales and operating results may be adversely affected.

Our success depends substantially upon the continued retention of certain key personnel.

We believe that our success has depended and continues to depend to a significant extent on the efforts and abilities of our senior management team and our board of directors. Our failure to retain members of that team could impede our ability to build on the efforts they have undertaken with respect to our business.

We do not maintain "key man" life insurance policies on our key personnel.

We do not have "key man" life insurance policies for any of our key personnel. If we were to obtain "key man" insurance for our key personnel, there can be no assurance that the amounts of such policies would be sufficient to pay losses experienced by us as a result of the loss of any of those personnel.

Our success depends upon our ability to attract, train and retain highly qualified managers and staff.

Our success depends in part on our ability to attract, hire, train and retain qualified managers and staff. Purchasing hard surface flooring is an infrequent event for BIY and DIY consumers, and the typical consumer in these groups has little knowledge of the range, characteristics and suitability of the products available before starting the purchasing process. Therefore, consumers in the hard surface flooring market expect to have sales associates serving them who are knowledgeable about the entire assortment of products offered by the retailer and the process of choosing and installing hard surface flooring.

Each of our stores is managed by a store manager who has the flexibility (with the support of regional managers) to use his or her knowledge of local market dynamics to customize each store in a way that is most likely to increase sales and profitability. Our store managers are also expected to anticipate, gauge and quickly respond to changing consumer demands in these markets. Further, it generally takes a substantial amount of time for our store managers to develop the entrepreneurial skills that we expect them to have in order to make our stores successful.

There is a high level of competition for qualified store managers and sales associates among home improvement and flooring retailers in local markets, and as a result, we may not succeed in attracting and retaining the personnel we require to conduct our current operations and support our plans for expansion. In addition, as we expand into new markets, we may find it more difficult to hire, develop and retain qualified employees. Any failure by us to attract, train and retain highly qualified managers and staff could adversely affect our operating results and future growth opportunities.

Our business exposes us to personal injury and product liability claims, which could result in negative publicity, harm our brand and adversely affect our business, financial condition and operating results.

Our stores and distribution centers are warehouse environments that involve the operation of forklifts and other machinery and the storage and movement of heavy merchandise, all of which are activities that have the inherent danger of injury or death to employees or customers despite safety precautions, training and compliance with federal, state and local health and safety regulations. While we have insurance coverage in place in addition to policies and procedures designed to minimize these risks, we may nonetheless be unable to avoid material liabilities for an injury or death arising out of these activities.

25

In addition, we may be subject to product liability claims for the products that we sell. We generally seek contractual indemnification and insurance coverage from our suppliers, and we carry our own insurance. However, our suppliers may not obtain the insurance coverage, the insurance coverage carried by us or our suppliers may not be adequate and/or such contractual indemnification we seek to require may not be available from or enforceable against the supplier, particularly because many of our suppliers are located outside of the United States. Any personal injury or product liability claim made against us, whether or not it has merit, could be time-consuming and costly to defend, result in negative publicity, harm our brand and could adversely affect our business, financial condition and operating results. In addition, any negative publicity involving our suppliers, employees, and other parties who are not within our control could adversely affect us.

Labor activities could cause labor relations difficulties for us.

Currently none of our employees is represented by a union; however, our employees have the right at any time to form or affiliate with a union. As we continue to grow and enter different regions, unions may attempt to organize all or part of our employee base at certain stores or within certain regions. We cannot predict the adverse effects that any future organizational activities will have on our business, financial condition and operating results. If we were to become subject to work stoppages, we could experience disruption in our operations and increases in our labor costs, either of which could adversely affect our business, financial condition and operating results.

Federal, state or local laws and regulations, or our failure to comply with such laws and regulations, could increase our expenses, restrict our ability to conduct our business and expose us to legal risks.

We are subject to a wide range of general and industry-specific laws and regulations imposed by federal, state and local authorities in the countries in which we operate including those related to customs, foreign operations (such as the FCPA), truth-in-advertising, consumer protection, privacy, product safety, intellectual property infringement, zoning and occupancy matters as well as the operation of retail stores and distribution facilities. In addition, various federal and state laws govern our relationship with, and other matters pertaining to, our employees, including wage and hour laws, laws governing independent contractor classifications, requirements to provide meal and rest periods or other benefits, family leave mandates, requirements regarding working conditions and accommodations to certain employees, citizenship or work authorization and related requirements, insurance and workers' compensation rules and anti-discrimination laws. In recent years, there has been an increase in the number of wage and hour class action claims that allege misclassification of overtime eligible workers and/or failure to pay overtime-eligible workers for all hours worked, particularly in the retail industry. Although we believe that we have complied with these laws and regulations, there is nevertheless a risk that we will become subject to such claims or any other claim that alleges a failure by us to comply with any of the foregoing laws and regulations. In addition, other parties in the flooring industry have been or currently are parties to litigation involving such claims, including patent claims. Any claim that alleges a failure by us to comply with any of the foregoing laws and regulations may subject us to fines, penalties, injunctions, litigation and/or potential criminal violations, which could adversely affect our reputation, business, financial condition and operating results.

With regard to our products, we may spend significant time and resources in order to comply with applicable advertising, labeling, importation, exportation, environmental, health and safety laws and regulations. If we violate these laws or regulations, we could experience delays in shipments of our goods, be subject to fines or penalties, be liable for costs and damages, or suffer reputational harm, any of which could reduce demand for our merchandise and adversely affect our business, financial condition and operating results.

26

Any changes to the foregoing laws or regulations or any new laws or regulations that are passed or go into effect may make it more difficult for us to operate our business and in turn adversely affect our operating results.